Embedded Insurance Market Overview: The global embedded insurance market is experiencing robust growth, with premiums valued at $78,693.58 million in 2023 and projected to reach $175,216.42 million by 2030, representing a CAGR of 11.63% during the forecast period (2024-2030).

Get An Exclusive Sample of The Embedded Insurance Market Report at This Link (Get the Higher Preference for Corporate Email ID): https://www.pragmamarketresearch.com/reports/121123/embedded-insurance-market-size/inquiry?UTM=RPM24

Embedded insurance refers to insurance products that are integrated into non-insurance products or services, offering consumers convenience and seamless coverage. Key players in the market include Travelers Insurance, Cover Genius, Metromile, Qover, Hokodo Services, ELEMENT Insurance, Bsurance, Simplesurance, Kasko, Wrisk Transfer, Extracover, and Penni.io.

Drivers:

- Consumer demand for convenience: Embedded insurance offers consumers the convenience of purchasing insurance along with other products or services, driving its adoption.

- Digitalization and technology: Advances in technology, such as digital platforms and APIs, are enabling the integration of insurance into various products and services, fueling market growth.

- Risk mitigation: Embedded insurance helps mitigate risks associated with non-insurance products or services, providing consumers with added security and peace of mind.

Opportunity:

- Expansion into new industries: There is a significant opportunity for embedded insurance providers to expand into new industries and partner with companies offering complementary products or services.

Inquire Before Purchase: https://www.pragmamarketresearch.com/reports/121123/embedded-insurance-market-size/inquiry?UTM=RPM24

Segmentation by Type:

- Life Insurance: Embedded life insurance products are integrated into products or services related to personal well-being, such as health and wellness apps or devices.

- Non-Life Insurance: Non-life insurance products, such as property and casualty insurance, are integrated into products or services related to property, travel, or automotive.

Segmentation by Application:

- Travel and Hospitality: Embedded insurance in the travel and hospitality industry covers risks associated with travel, accommodation, and related services.

- Automotive: Embedded insurance in the automotive industry covers risks related to vehicle ownership, usage, and maintenance.

- Consumer Products: Embedded insurance in consumer products covers risks associated with the purchase and use of consumer goods, such as electronics or appliances.

- Real Estate: Embedded insurance in real estate covers risks related to property ownership, rental, or leasing.

- Others: Other applications of embedded insurance include insurance integrated into financial services, healthcare, and other industries.

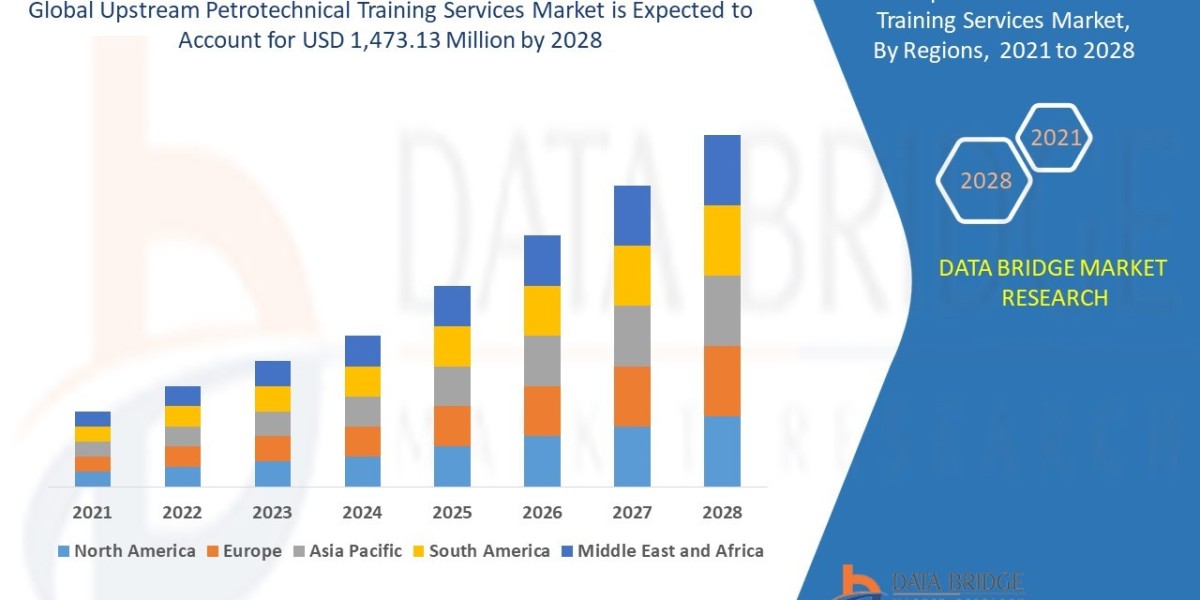

Segmented by Region:

- North America: North America is a major market for embedded insurance, driven by the region's advanced digital infrastructure and consumer demand for convenience.

- Europe: Europe is another key market for embedded insurance, with countries such as the UK, Germany, and France leading the way in adoption.

- Asia Pacific: The Asia Pacific region is witnessing rapid digitalization and urbanization, driving the demand for embedded insurance in industries such as e-commerce, travel, and automotive.

- South America: South America is an emerging market for embedded insurance, with increasing consumer awareness and adoption of digital services.

- Middle East and Africa: The Middle East and Africa are also emerging markets for embedded insurance, driven by the region's growing middle class and increasing disposable income.

Trends:

- Customization and personalization: Embedded insurance providers are increasingly offering customizable and personalized insurance products to meet the diverse needs of consumers.

- Integration with digital platforms: Embedded insurance is being integrated into digital platforms such as e-commerce websites and mobile apps to offer seamless insurance purchasing experiences.

- Partnerships and collaborations: Companies are forming partnerships and collaborations to expand their embedded insurance offerings and reach new markets and customer segments.

To Know more about this report (Description, TOC and List of Tables and Figures) - Embedded Insurance Market

Challenges:

- Regulatory compliance: Ensuring compliance with insurance regulations in different regions and industries can be challenging for embedded insurance providers.

- Data privacy and security: Protecting consumer data and ensuring its privacy and security are major challenges for embedded insurance providers.

- Consumer education: Educating consumers about the benefits and features of embedded insurance products is crucial for market adoption and growth.

Recent Developments:

- Expansion of product offerings: Embedded insurance providers are expanding their product offerings to include new types of insurance and coverage options.

- Enhanced digital capabilities: Companies are investing in digital technologies to enhance their embedded insurance platforms and offer more seamless and efficient services.

- Focus on customer experience: Providers are focusing on improving the customer experience through better user interfaces, faster processing times, and improved customer support.

Conclusion: The global embedded insurance market is experiencing rapid growth, driven by consumer demand for convenience, digitalization, and advances in technology. Key players in the market are focusing on customization, digital integration, and partnerships to capitalize on this growing market opportunity. Despite challenges such as regulatory compliance and data privacy, the market presents significant opportunities for growth and innovation in the coming years.

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by Type, by Application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: Introduces executive summary of global market size, regional market size, this section also introduces the market dynamics, latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by companies in the industry, and the analysis of relevant policies in the industry.

Chapter 3: Detailed analysis of Embedded Insurance company competitive landscape, revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 5: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 6, 7, 8, 9, 10: North America, Europe, Asia Pacific, Latin America, Middle East and Africa segment by country. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and capacity of each country in the world.

Chapter 11: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 12: The main points and conclusions of the report.

To access valuable insights within the ‘Embedded Insurance Market’ report, please share your contact details and express your intent to procure the report. Our dedicated sales team will promptly connect with you to provide additional information on the purchasing process for the “Embedded Insurance Market” report (Single User License).

Note:

- Custom research reports can be available upon request.

- If you wish to request a discount, please refer to the discount link on our website or send an email to sales@pragmamarketresearch.com.

About us:

Pragma Market Research is a dynamic market research and consulting firm with experienced analysts in various industries. Our industries of expertise include Medical Devices, Pharmaceuticals, Semiconductors, Machinery, Information and Communication Technology, Automobiles, Chemicals and Materials, Packaging, Food and Beverages, Specialty Chemicals, Fast Moving Consumer Goods, and more.

Contact Us:

Akshay G.

+1 425 230 0999