The global cloth diaper market size was valued at USD 2.86 billion in 2022 and is projected to reach a valuation of USD 3.07 billion in 2023. The market is expected to reach USD 5.33 billion by 2030 with a CAGR of 8.2% during the forecast period. Rising demand for alternatives to disposable products is expected to propel the market course in a growing direction. Fortune Business Insights™ shares this information in its report titled “Cloth Diaper Market, 2023-2030.”

Information Source:

https://www.fortunebusinessinsights.com/cloth-diapers-market-103901

Fortune Business Insights™ lists out all the cloth diaper market companies that are presently striving to reduce the impact of the Covid-19 pandemic on the market:

- The Procter & Gamble Company (U.S.)

- Babeegreens (U.S.)

- Thirsties Baby (U.S.)

- Modern Cloth Nappies (U.K.)

- Cotton Babies, Inc. (U.S.)

- LittleLamb (K.)

- Com (U.S.)

- Kinder Cloth Diaper Co. (U.S.)

- Navashya Consumer Products Pvt. Ltd. (India)

- Happy BeeHinds Cloth Diaper Company (U.S.)

Report Coverage

The report provides a detailed analysis of the top segments and the latest trends in the market. It comprehensively discusses the driving and restraining factors and the impact of COVID-19 on the market. Additionally, it examines the regional developments and the strategies undertaken by the market's key players.

Drivers and Restraints

Preference for Sustainable Nappies to Drive Product Expansion

Increasing preference for sustainable nappies made from natural materials such as natural cotton, bamboo, hemp, microfiber, and others is anticipated to drive the cloth diaper market growth. Increasing popularity for using biodegradable and compostable material-based adult briefs to avoid skin irritation while using disposable products among the aged population is accelerating the market growth. Rising demand for higher absorption property-based cotton briefs and boxers for treating incontinence problems is set to favor the product demand.

However, regular unorganized provision by the industry players for nappy products with their competitive pricing is projected to obstruct market growth.

Segments

Babies Segment to Lead Due to Increasing Spending on Childcare Products

On the basis of end-users, the market is divided into adults and babies. Babies segment is anticipated to dominate due to the major parental population’s spending on childcare products. Babies segment is further segmented into economic and premium. Between the two, the economic segment is being driven by middle-income households preferring cost-effective flat and pre-fold nappies for their babies. The premium segment is driven by consumer preference for skin-friendly and comfortable high-end pocket, fitted, and all-in-one nappies. The adult segment is driven by a surge in a number of working women populace and spending on premium-quality cotton briefs.

Offline Channel to Lead the Segment due to Easy Availability of Hygiene Products

Based on the distribution channel, the market is divided into online and offline. The offline segment is expected to have a major part due to regular discounted prices on baby care products by convenience stores and supermarkets to increase product demand and favor offline segmental revenues. The offline segment includes various distribution channels such as pharmacy stores, hypermarkets & supermarkets, and convenience stores.

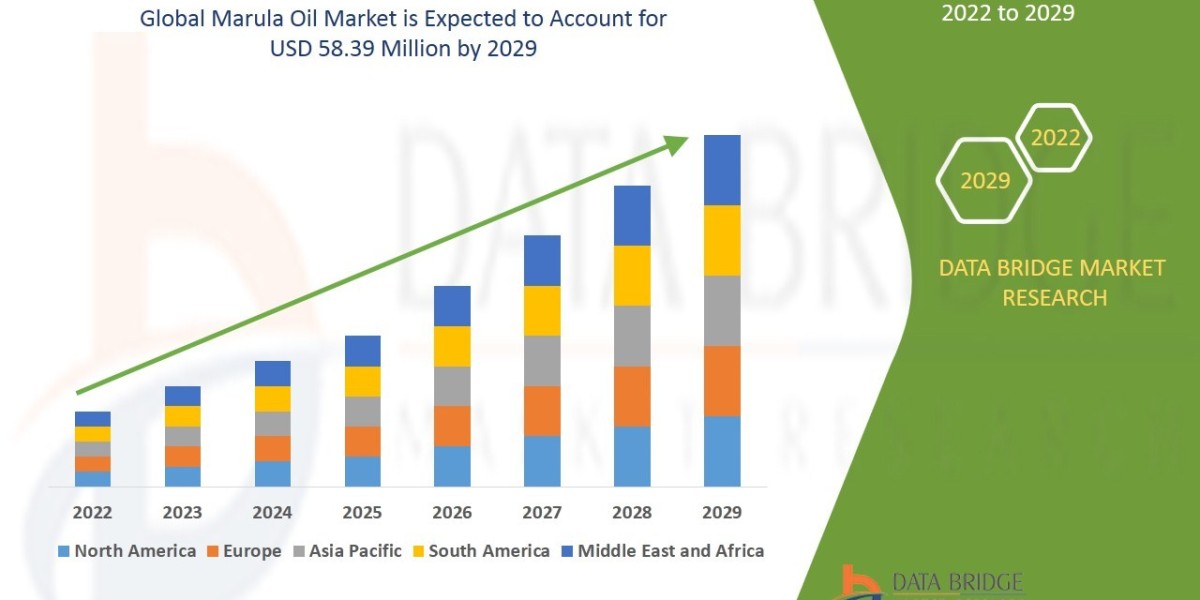

Geographically, the market is segregated into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Regional Insights

Asia Pacific to Have Dominance in Market Share Due to Highest Market Valuation

Asia Pacific is expected to govern the cloth diaper market share as it reached the valuation of USD 1.2 billion in the year 2022, with the largest share being held by Chinese and Southeast Asian countries. According to the World Bank Group, in 2021, nearly 29% of the Japanese population was aged 65 years and above compared to 28% in 2019.

The market in the North American region is driven by the rising number of single-parent households and their spending on infant care products, which is favoring the product revenues. According to the U.S. Census Bureau, there were 9.5 million single-person households in the U.S., and single-mother households made up more than 80% of such households in the country in 2020.

The European market is set to have significant growth due to governmental and water supply management agencies focusing on introducing reusable diaper-related awareness campaigns to reduce waste generation due to disposable nappies and wipes.

Competitive Landscape

Enhancement of Product Portfolio by Key Players to Develop Market Trajectory

Key market players have been launching new products to enhance their product portfolio. In May 2021, the Procter & Gamble Company launched ‘Pampers Pure Protection Hybrid Diapers’, a range of premium and super absorbent fabric-based diapers that can be disposed off or reused by babies. They are furnished with reusable cloth diaper covers and disposable inserts and enhanced leakage protection features. The new range of products is set to propel market growth.

Key Industry Development:

- December 2022: TerraCycle, a waste management company based in the U.S., launched a cotton nappies supply service under its reuse platform Loop in the U.S.